Inequality for All

Watched the film "Inequality for All" on Netflix the other night. For those who follow this board I'm sure you would all find it interesting. I'd give it 4 starts. Robert Reich gave some interesting analysis on the wealth gap. Be interested in hearing others opinions.

If you analyze the current global financial setting you will find that "Old money" owns everything and its just getting consolidated more and more.

My assessment: We either start using decentralized crypto currency (BITCOIN) or continue to revel in our surfdom.

Depending on your definition of "Old money", By my count, 14 out of the top 25 richest Americans are "New Money". Step out and develop the next Microsoft, Google, Facebook, Casino, Oracle, etc and you can join the elite.

Currency isn't the main factor, we've just become a very specialized society that has had an influx of cheap labor. There aren't a lot of barriers to entry for someone working at MCD, pushing a broom on a shop floor, etc

The genie is out of the bottle

While globalization and technology have played a part, the reduction in working wage, increased cost of education, and other factors outlined in this documentary provide a very interesting analysis of our current state. When in the early 70's the median working wage was the equivalence of 45k (in today's dollars) and is now 33k, and the cost of living has increased, it is of little wonder why the two income household has become the norm and our children have less chance of doing as well in today's world. The % of Americans with degrees has fallen and a lot of those that do, now start life loaded with debt. This is not an ideal model for growth and community well being.

Depending on your definition of "Old money", By my count, 14 out of the top 25 richest Americans are "New Money". Step out and develop the next Microsoft, Google, Facebook, Casino, Oracle, etc and you can join the elite.

Currency isn't the main factor, we've just become a very specialized society that has had an influx of cheap labor. There aren't a lot of barriers to entry for someone working at MCD, pushing a broom on a shop floor, etc

The genie is out of the bottle

I'm talking about the money that you never see.

Forbes says Bill gates is the richest man in the world:

http://www.forbes.com/sites/abrambrown/2014/03/03/forbes-billionaires-full-list-of-the-worlds-500-richest-people/

But why don't we see the trillionaires??

The Rothchild holdings are measured in trillions, most the old banking families are.

and who really runs the world?

Rothschild Brothers of London, 1863. "Give me control of a nation's money and I care not who makes it's laws" — Mayer Amschel Bauer Rothschild

Banks, it's always been this way and it always will be this way until us little people pull our heads out of the sand and understand the way money works, especially Fractional Reserve Lending & the true creation of money (why don't people wonder at the fact banks always have some of the largest buildings in every town in the world... that seems like a blatant display of wealth that goes seemingly un-noticed.)

http://www.themoneymasters.com/

https://www.youtube.com/watch?v=HfpO-WBz_mw

One of these days we will collectively wake up, Bitcoin is a shot over the bow of the established money manipulators... Times are changing.

While globalization and technology have played a part, the reduction in working wage, increased cost of education, and other factors outlined in this documentary provide a very interesting analysis of our current state. When in the early 70's the median working wage was the equivalence of 45k (in today's dollars) and is now 33k, and the cost of living has increased, it is of little wonder why the two income household has become the norm and our children have less chance of doing as well in today's world. The % of Americans with degrees has fallen and a lot of those that do, now start life loaded with debt. This is not an ideal model for growth and community well being.

The cost of living isn't apples to apples. I think people in the 70's would be amazed at what the average has.

A TV, car, toaster in the 70's isn't the same as one today. It also takes less hours worked for the average American to buy many items than it did in the 70's. See -

The % degrees looks like its increasing - http://www.nytimes.com/2013/06/13/education/a-sharp-rise-in-americans-with-college-degrees.html?pagewanted=all&_r=0

Now with that being said, I do think we have a serious structural employment issue. We're going through a second Industrial age where the jobs our forefathers had wont be around. We need some wholesale changes to our educational system to better prepare the youth for the jobs of tomorrow vice the jobs of yesterday

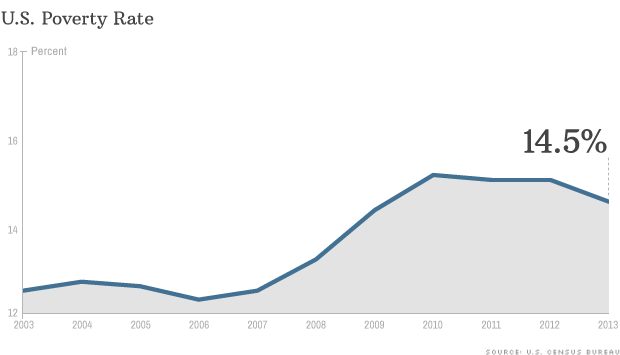

Well people below the poverty line has gone down:

U.S. poverty rate drops for first time since 2006

There's not much good news for working Americans struggling to rebound from the recession, except perhaps this: the U.S. poverty rate is finally on the decline.

The nation's poverty rate fell to 14.5% in 2013, down from 15% a year earlier, the U.S. Census Bureau reported Tuesday. This is the first statistically significant drop in poverty since 2006, when it was 12.3%.

A lot of the decrease is coming from people finding full-time work -- and thus earning more money. But the number of people in poverty remains stuck at 45.3 million. As America's population expands, the job growth hasn't kept pace.

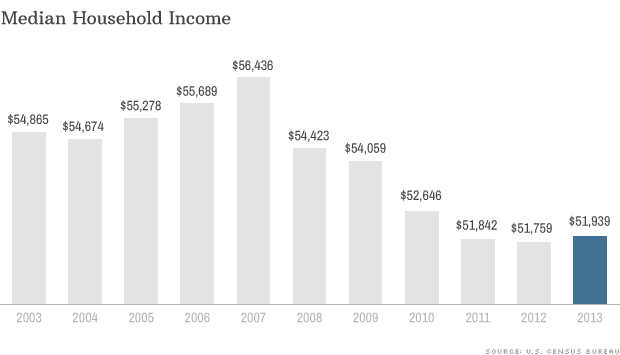

Middle class Americans have even less to celebrate. Median household income remained essentially flat in 2013 at $51,939.

What's worse, median income remains only a touch above where it was in 1995. So the middle class has retained none of the gains from the economic booms of the late 1990s and mid 2000s.

And they have yet climb out of the hole of the Great Recession. Median income remains 8% lower than in 2007.

Not everyone's income, however, is stuck in neutral. The richest Americans -- those in the top 5% -- have seen their incomes shoot up 14% since 1995.

Stagnating wages are the main cause for this widening gap. Paychecks have remained the same or have shrunk for the vast majority of Americans since 1979, according to the Economic Policy Institute, a liberal think tank. But the wealthy rely more on investment income, which has skyrocketed with the rising stock market.

There were some bright spots in the Census report. The median income for young people -- age 15 to 24 -- jumped over 10%, the first increase since 2006. And senior citizens saw their median income rise about 4%, the first increase since 2009.

Hispanics saw their median income tick up 3.5%, but they were the only group to see a significant change.

The poverty rate has been edging downward since it peaked at 15.1% in 2010. More people near the bottom of the income ladder are working, said Charles Nelson, assistant division chief for economic characteristics at the Census Bureau. Some 2.8 million more people were working full-time in 2013 compared to a year earlier.

Two groups saw significant decreases in their poverty rates. The number of children in poverty fell to 14.7 million, or 19.9%, down from 16.1 million, or 21.8%, the first decline since 2000. That's because many of their parents have now found full-time work.

And Hispanics saw their poverty rate fall to 23.5%, from 25.6%.

The poverty threshold for two adults and two children in the U.S. is $23,624.

The poverty level is $24k for four? $6k each a year? I barely live on $9k a year!

a lot of the "old money" has gone away due to the way generations of those wealthy have spent their fortunes and how they willed the money. there was a valid reason for giving the majority of money to the oldest male heir in a family-to keep it together.

i agree with the wages of the 70's not being near what they would be today.

but why are the rich so vilified. the majority of them actually earned their money the old fashioned way. and even if they didnt so what. it is their money to do with as they please-right

should they make sure all of the uneducated, the one who do not want to work , the poor-should they really need t give their money away?

should they make sure all of the uneducated, the one who do not want to work , the poor-should they really need t give their money away?

No they shouldn't but they also should not prevent others from following in their foot steps. Something that is done via government regulation all the time (a product of the insane political lobbying industry). Also just because you have money doesn't mean you get more of a voice, this leads to de-humanization and "cast" systems like india had.

Corporations also should not be given "person" status & should not be allowed to be long standing like they are now, traditionally corporations only existed to complete a project and then their charter expired.

Or

If corporations are to retain their "person" status then everyone involved in those corporations should bear the burden of the corporation’s actions, like when Pfizer kills patients via bad drugs, everyone should be charged with negligent homicide, that's what would happen to a "person".

My assessment: We either start using decentralized crypto currency (BITCOIN) or continue to revel in our surfdom.

Just curious, how would something like Bitcoin (which is traded in dollars) have any effect on a country's Gini coefficient (income inequality)? Just not understanding this part of your argument. Thanks.

actually, liquid, those with the most money do have more of a voice-just look at campaign contributors. i dont think that is right either. but it is a fact unless they can set limits of what a corp or person can contribute.

interesting take on corporations and negligence

I remember my father used to get around donation limits by making a gift to his friends and having them donate it.

How wonderful. You come from a whole line of miscreants!

I remember my father used to get around donation limits by making a gift to his friends and having them donate it.

My assessment: We either start using decentralized crypto currency (BITCOIN) or continue to revel in our surfdom.

Just curious, how would something like Bitcoin (which is traded in dollars) have any effect on a country's Gini coefficient (income inequality)? Just not understanding this part of your argument. Thanks.

Bitcoin is itself a currency, which CAN BE converted to dollars, Yen, Denari etc.. if the holder so chooses.

Bitcoin cannot be inflated, it intrinsically has a limit and thus will become "worth more" (which inherently encourages saving & preserves the wealth of families that is currently eroded by the "inflation rate" today of all modern fiat currency).

Unlike modern banking bitcoin is built on simplicity and transparency, there are no charges, fees or restrictions on the use of bitcoin and it can be traded in anonymity (assuming we put a stop to the NSA collecting all internet traffic..)

Bitcoin will do several things to governments directly:

https://www.youtube.com/watch?v=0GL9PTQiqxw

Wars will not be fought with out consent of the constituents (there will be no "central bank" that can create currency when ever a war effort is needs it).

Government actions that take money (almost all actions) will have to be approved by the population for the same reason.

With these actions "leveling the playing field" and holding the government in more of a subservient role with its constituents; income - inequality will loose it's greatest defender, that which is SUPPOSE to be all of our defenders: the government.

jane, i bet you that most politicians do that and not just noOne

jane, i bet you that most politicians do that and not just noOne

Also what I described is not illegal. As for my father being a criminal... well he did own a dozen business over his lifetime and probably has contributed more than anyone else here to the economy of the USVI and in taxes... but yeah, he was a criminal that was only "caught" after death by the IRS...

I don't even know where to start on this one. So far, bitcoin has had 10x the volatility of most every currency - where is the stability in that? The #1 Bitcoin exchange imploded, leaving all their bitcoin "holders" holding something very different then thought they had. Maybe they could exchange them for some Dutch tulip bulbs?

Bitcoin is a great refuge for illegal activity and money laundering, and that is why governments will continue to fight it. Refresh my memory on which banks allow deposits and withdrawn in bitcoin again? Maybe it's changed.

Regardless, Bitcoin, or any other cybercurrency, will do nothing, not nothing to income inequality. How could it? When income inequality is fought by collection of taxes from the wealthy (in dollars) and transfer payments to those with less income (subsidies, welfare, etc), are also made in dollars, how could Bitcoin possibly make income inequality less? That appears to be the central point to your argument and to me something like adoption of a non-government currency would actually have the opposite effect. This does not even consider the fact that having manipulatable currency is needed to fight the brutal peaks and valleys of the normal business/growth cycle. I would hope not to see a return to the awful panics we used to endure in the gold standard days before the Fed was created or learned how to use monetary policy to mitigate those natural cycles.

Bitcoin is a great refuge for illegal activity and money laundering, and that is why governments will continue to fight it.

Yeah current banks are never involved in illegal activity.

I don't even know where to start on this one. So far, bitcoin has had 10x the volatility of most every currency - where is the stability in that?

Did you know that 95% of the statistics on the internet are made up?

Here's a 4 year chart of bitcoin:

If that's volatility then I'm all for it.

The #1 Bitcoin exchange imploded, leaving all their bitcoin "holders" holding something very different then thought they had. Maybe they could exchange them for some Dutch tulip bulbs?

Sounds like you watch a lot of TV, do you know what Mt Gox was? do you understand the point of bitcoin?

Mt Gox was first off, not an exchange originally, MTGOX stands for (Magic the Gathering Online Exchange) yes, it was a trading place for playing cards.... then it tryed to make itself a "bank" for Bitcoin; but the whole point of bitcoin is to get rid of banks and their money manipulation.

the funnything about that incident is this: since the blockchain is public, the second any of those bitcoins get spent the "theif" will be outted... so this situation is not over & probably won't happen again due to lessons learned.

Bitcoin is a great refuge for illegal activity and money laundering, and that is why governments will continue to fight it.

and cash isn't?

how about this found in a mexican drug cartel house

Your argument falls very flat here.

Refresh my memory on which banks allow deposits and withdrawn in bitcoin again? Maybe it's changed.

The fact that you asked this question tells me you do not understand bitcoin at all; the purpose of bitcoin is to remove banks from the equation. we do NOT need the "money changers" and never really have.

Regardless, Bitcoin, or any other cybercurrency, will do nothing, not nothing to income inequality. How could it? When income inequality is fought by collection of taxes from the wealthy (in dollars) and transfer payments to those with less income (subsidies, welfare, etc), are also made in dollars, how could Bitcoin possibly make income inequality less?

Really? equality comes from robbing one group and giving to another? If you truely believe this then I do not think you have a very good grasp of economics, especially the current fascist-petro-dollar system we function under.

Government currently PROTECTS the ultra wealthy and does not transfer any money to the poor (though it would be wrong of it if it did).

That appears to be the central point to your argument and to me something like adoption of a non-government currency would actually have the opposite effect. This does not even consider the fact that having manipulatable currency is needed to fight the brutal peaks and valleys of the normal business/growth cycle. I would hope not to see a return to the awful panics we used to endure in the gold standard days before the Fed was created or learned how to use monetary policy....

Ok, what you are talking about is refereed to as Keynesian Economics (I assume you were not aware, feel free to read up on it) and it is NOT needed at all.

In fact if you look at the last 100 years you'll find that every boom/bust cycle was caused BY the federal reserve policy and was used to consolidate wealth further into the hands of the ultra rich (we are about as far in that direction now as it is possible to go due to Keynesian Economics and our corpratist government).

I have done thousands of hours of research on this; I did not simply glean this from TV as it appears you have.

I'll finish with this: Things are not always what they seem, question everything; ALWAYS. (even this, do your own research)

here's a great example of what the Central bank in the US has given us, if the dates aren't clear (they should be) I can explain further.

This is the outcome of Keynesian economics. The only "redistribution" that happens goes in the exact opposite of what you believe to be happening; God Bless America!

Ok, what you are talking about is refereed to as Keynesian Economics (I assume you were not aware, feel free to read up on it) and it is NOT needed at all.

Thanks for the tip 😉 I do actually know enough about it that firms and organizations fly me to their states to give talks on monetary policy, so I'm not exactly getting my opinions 'from TV', but regardless I've erred in butting into this thread. We can't really have a discussion about what color the sky is if we differ on what planet we're on.

I yield and exit stage left.

Thanks for the tip 😉 I do actually know enough about it that firms and organizations fly me to their states to give talks on monetary policy, so I'm not exactly getting my opinions 'from TV', but regardless I've erred in butting into this thread. We can't really have a discussion about what color the sky is if we differ on what planet we're on.

I yield and exit stage left.

That's the scary part, Keynesian followers are so blind to what is actually happening. On paper, and assuming that everyone plays fair, it seems like a great way to manage something that needs managing (there's the first assumption, that it needs managing)

In reality the economy should find it's own balance, any outside influence will cause havoc (and we have seen this repeatedly).

I hope you know by not fully understanding all sides of the situation you are a part of the problem if people come to you for consultation.

The fact that you did (or do) not understand the concept of crypto currency and think that wealth equality is given at the hands of the government is quite disturbing.

But your old, white and male, probably living east coast in or near a big city and you vote democratic; at least that's the group-think ideas you espouse.

Good luck with the attitude of " I know it already, no need to debate" I'm sure that no one else has a valid thought to offer to you, especially me, no one flys out to consult with me.

LF - You might want to back off calling anyone that thinks there is a role for a central bank a Keynesian.

Non-Keynesians like Milton Friedman and John Taylor believe the central banks have a role/benefit. Where they differ is how Fed policy is implemented. MF (and I believe JT) wanted more of a structure for policy implementation vice being more of a political tool - or at a minimum had the potential to be

LF - You might want to back off calling anyone that thinks there is a role for a central bank a Keynesian.

Non-Keynesians like Milton Friedman and John Taylor believe the central banks have a role/benefit. Where they differ is how Fed policy is implemented. MF (and I believe JT) wanted more of a structure for policy implementation vice being more of a political tool - or at a minimum had the potential to be

Very true, central management does have a place in other schools of thought, even the Austrian approach.

I personally abhor central management, consolidated power never seems to work out, we have thousands of historic examples of this.

was that my money

- 4 Forums

- 32.9 K Topics

- 272.3 K Posts

- 155 Online

- 41.1 K Members