Financial News Service Questions V.I.'s Ability To Sell Bonds

I would think by now, most investors would know that the VI is only one step behind Puerto Rico financially.

I would think by now, most investors would know that the VI is only one step behind Puerto Rico financially.

aren't we technically worse off, percapita?

More in Debt Than Puerto Rico, the Virgin Islands Rejects Rescue

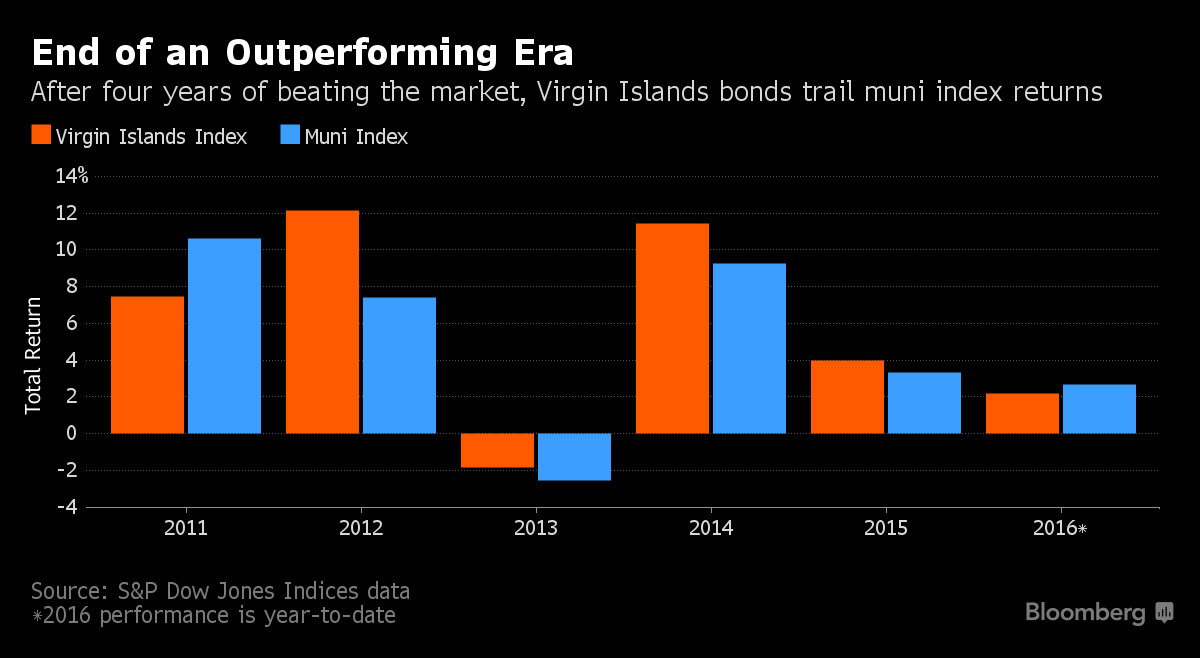

Congress’s plan to throw a lifeline to Puerto Rico is making waves in the U.S. Virgin Islands.The measure that passed a House committee last week would allow for a federal control board to oversee the finances -- and potentially restructure the debt -- of any U.S. territory, even though Puerto Rico is the only one now asking for help. Virgin Islands Governor Kenneth Mapp and Rep. Stacey Plaskett have blasted the bill, warning that it may tarnish its standing with investors. That concern is already starting to materialize: Returns on its securities are trailing the $3.7 trillion municipal market for the first time since 2011.

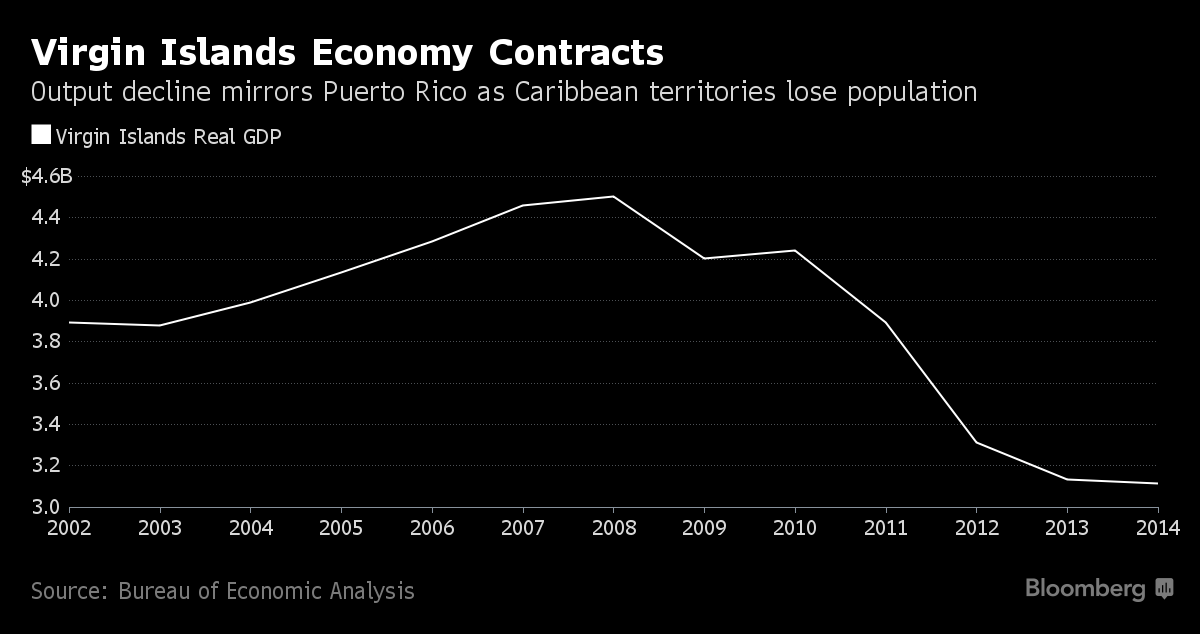

The Caribbean island, Puerto Rico’s closest American neighbor, has a sliver of the population -- about 104,300 -- and a fraction of the debt, with $2.4 billion across all issuers. But divvied up, that’s $23,000 of obligations per person, even more than Puerto Rico’s $20,000. The two Caribbean territories with a shared culture also have similar fiscal strains: declining populations, underfunded pensions, histories of borrowing to cover budget shortfalls and unemployment rates that are twice as high as the U.S. mainland’s.“It’s the same template: Over a period of years, you keep issuing debt to cover your operating deficits, your economy isn’t growing, your population isn’t growing, but your liabilities keep growing,” said David Ashley, an associate portfolio manager at Thornburg Investment Management, which holds $11.5 billion in municipal bonds. “Just by virtue of math, your per-capita debt just continues to rise, probably to an unsustainable level at a certain point.”

Well isn't this typical and sadly ironic, I read this post about "fiscal strains: declining populations, underfunded pensions, histories of borrowing to cover budget shortfalls and unemployment rates" and then read another post on dental assistant positions and Tommy looking for a building contractor. And it's a fact that many businesses in the trades have moved off island presumably due to lower demand further pushing the downward spiral, yet there is demand out there. Seems a lot of this circles back to having the skills and education to match with the demand for jobs and opportunities that we do have.

I think part of PR's problem is that many of the residents have been moving off the island for sometime now and they never reacted to that, whereas the VI population seems to stay consistent in numbers. So the VI can probably operate for many years to come as they can keep the income to debt ratio much closer than PR could due to the loss of revenue. Or I could be totally wrong and the VI is screwed.

dave: You don't think that a lot of the increase in population comes from Haiti and the DR, basically working service jobs?

I think part of PR's problem is that many of the residents have been moving off the island for sometime now and they never reacted to that, whereas the VI population seems to stay consistent in numbers. So the VI can probably operate for many years to come as they can keep the income to debt ratio much closer than PR could due to the loss of revenue. Or I could be totally wrong and the VI is screwed.

Disregard this, as I don't know wtf I am talking about. Sorry for wasting your time. Nothing to see, move along.. LOL

I just googled PR's pop, they have only lost 100,000 since 2005.

Budget control, level off taxes, create more business. That makes more sense. See you all tomorrow. To bad we couldn't all meet up and enjoy a drink, after this year, we all need one. 🙂

Plenty of factoids available about PR decline.

One half of PR companies operate in cash economy. Doesn't pay any taxes.

30% of PR population declares ZERO income.

There are towns in PR where entire population in on SSD or WC.

PR created universal healthcare for the residents.

That is enough to drive the island into economic decline.

The marriage of American socialism with Caribbean productivity leads to unbalanced budget. There are simply not enough producers to support all the moochers.

- 4 Forums

- 32.9 K Topics

- 272.3 K Posts

- 146 Online

- 41.2 K Members